RIPPED FROM THE HEADLINES

Yieldstreet offers an art debt fund and an update on our art fund simulation

YIELDSTREET ART AND ART DEBT FUNDS:

Last Friday, November 25, as I was eating leftover pie and going through my email, I saw an interesting article from The Art Newspaper about the investment company Yieldstreet securitizing art loans. (I will explain what this is in a bit.) The name sounded familiar to me, so I went back to an older Artnet article about art funds, and voila! Yieldstreet was one of the companies they wrote about.

Yieldstreet offers regular folks the opportunity to invest in private rather than public markets. Usually, when you buy a stock, you are purchasing a share in a public company, and there are a lot of rules set up by the government to protect you. Companies are supposed to be pretty transparent with what they do with their money, and stockholders are technically able to have some influence over what the company does. (It’s a flawed system, but it does make some attempt at accountability.) Private company investments have fewer safeguards, which can make them riskier, but they also have the possibility of greater rewards. In addition, Yieldstreet has also put together some art funds, and their current offering allows investors to buy shares in six paintings by Jean-Michel Basquiat, Lucio Fontana, Ed Ruscha, Damien Hirst, and Sol Lewitt and is meant to appeal to general investors rather than art collectors. It is interesting to me that while these pieces are promoted simply as financial assets, it is their (perceived) social value that gives them monetary worth. However, this system works hard to make sure that value is never realized. No one is gonna take a school trip to the warehouse to look at the Basquiat. (Not yet anyway.)

Anyhoo, Yieldstreet also owns Athena Art Finance, which is a company that lets people borrow against their fancy art. I wrote a bit about these types of loans when discussing David Ganek’s ownership of Apocalypse Now. Art that just hangs there is like nailing a suitcase full of cash to the wall. But if you take a loan against it, you can reach right into that bag and take out handfuls of money to put into other things; superrich people tend to have a lot of debt because investing the dough they get from loans is how they make more money. Athena then bundles those loans together and sells them off to investors as part of a diversified art debt portfolio. Athena gets their money back from the loans sooner, and investors get some of those sweet sweet interest fees. (Does this seem familiar? If not, I would like to introduce you to the financial crisis of 2007/2008 where this kind of home loan debt instrument helped decimate the economy. A link in case you want to refresh your memory.)

The debt portfolio is the newest of their art-related offerings, and I think this is what they want to happen: Athena lends money to borrowers who are using art as collateral. They will then bundle those loans together and sell them to investors. Athena (which is really Yieldstreet) takes the money from that sale and uses it to purchase more art. (This is pure speculation on my part, but since both the art fund and the debt portfolio are managed by Athena, it’s a good guess.) That art is then used to create art fund portfolios which are also sold off to investors. The money from those sales is either put back into the business or paid out to the dudes who own the company. Now, there is no way the failure of any part of this system can have the same impact as the housing crisis did on our economy, but it is still worrisome to me for several reasons. One is that like all of these art funds, it assumes that the prices of art are just going to go up and up, even when they are already so high. (That’s what they believed about the housing market in 2007.) The debt portfolio also assumes that the economy is going to remain strong and people are going to be able to pay back those loans. (Another thing they believed about home loans in 2007 that did not prove to be real.) But the thing that bugs me most is that this is a frictionless system. Everything is done in-house, so if someone was doing something hinky, it would be easy to hide because there are no outside parties to overlook the transactions. It’s also hard to know if they are securitizing the debt because they think it is a good idea or because they need the money. Now, TO BE CLEAR, I have no reason to think anybody is doing anything bad here, but it’s all happening behind closed doors; the people who buy into the debt fund don’t even know who the debtors are according to The Art Newspaper. I dunno, maybe this is all perfectly fine, but I would do a lot more research before I considered investing in any of these funds. (As a note, I am not interested in investing in art funds for a lot of reasons. Mostly because that is not how I want to interact with art, but also because a lot of these companies seem kinda douchey to me.)

ART FUND SIMULATION UPDATE:

The deadline for signing up to be part of the simulation has passed and we have an art fund! (SIMULATION FOR EDUCATIONAL PURPOSES ONLY.) The deadline for payment is December 1st, but if everyone pays, here is what the breakdown will look like.

Number of Investors: 19

Amount Raised: $76

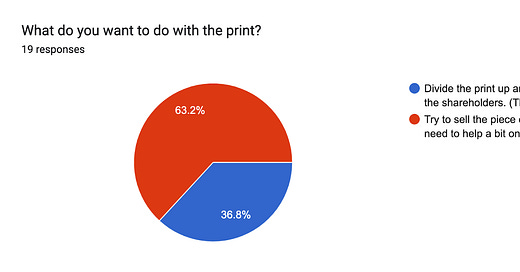

It looks like we are taking the print to auction! (Btw, even if some or all of the outstanding payments do not get made, the voters who have already paid are overwhelmingly in favor of selling.) If we sell the print, the proceeds will be divided proportionally amongst the shareholders. If not, they will receive their section of the print.

The auction will take place on eBay from December 6 - 11. On Wednesday, Dec 7, I will be posting another newsletter with the link to the auction in case you wish to purchase this amazing print or just wish to follow along. I will also be discussing Jeff Koons and the use of multiples to extract lots of cash from risk-averse collectors.

FURTHER READING:

https://news.artnet.com/market/athena-art-finance-yiledstreet-1513456